17th November, 2021

A raft of new updates to MYOB products brings major changes, including improvements to Essentials, AccountRight and the release of MYOB Business in Australia.

Looking at the list of changes, improvements and updates across the MYOB range in October, there’s a lot for accounting and bookkeeping advisors to catch up on, least of all being MYOB Business – a new business management platform for small and medium entities of up to 20 full-time employees.

Continue reading to find out what’s new in your MYOB products so that you can work more efficiently and keep your clients’ businesses running smoothly.

Missed the headlines from MYOB in October? Well, the software provider kicked off the month with the launch of MYOB Business, which brings together the best of its small and medium business offerings into one platform.

For advisors, that means there’s a new, comprehensive MYOB product that can help your clients grow and maintain compliance along the way.

READ: What does the launch of MYOB Business mean for Essentials and AccountRight?

For existing users of MYOB’s online products, Essentials (new) and AccountRight in the browser, there are several upgrades and improvements to be aware of.

Firstly, MYOB has made it easier for small and medium business clients to get set up for working with their advisors by improving the Chart of Accounts, which automatically maps back to the advisor’s Client Accounting module, so there’s no need for manually inputting this information.

MYOB has also included general journals in recurring transactions, improving the automation of accounts further still.

AccountRight users will notice MYOB has changed how updates are rolled out.

If you’re using version 2021.5 or later, these released will be performed incrementally and that means less downtime for advisors and their clients.

MYOB has also added a new feature to help businesses manage their employees’ leave through MYOB Team.

Businesses can now create, review, and approve their employees’ leave to track their availability and reduce payroll errors.

MYOB Team app users will see a new ‘Leave’ menu on the latest version of the MYOB Team app.

This feature enables the following activities for managers and employees:

As a manager, users can perform the following actions via the MYOB Team admin portal:

For more information about Leave Management within MYOB Team, please visit the Leave Management section of the MYOB Team Online Help Guide.

As of 25 October, businesses can seek loans via a new partnership between MYOB and Valiant.

Founded in 2015, Valiant is an Australian, one-stop-shop for all things business finance. Their aim is to help businesses navigate through the business loan jungle by distilling loan options from over 80 lenders.

They’ve helped over 8,400 Australian businesses with their finance needs and, now Valiant lending is available for all MYOB Business (except Payroll Only), Essentials (new) and AccountRight subscriptions.

To start a free and no obligation conversation with Valiant to discuss business financing and loans for yourself or your clients, all you need to do is request a call back or a quote from within the MYOB platform in your browser.

READ: New solution to make access to working capital simpler

As part of the MYOB Business launch, MYOB has reviewed how bank feeds are used and have enabled a new feature where customers can cancel bank feeds they’re no longer using.

This change will directly benefit customers on MYOB Business Lite where there is a limit of two bank feeds, as well as customers on other MYOB products that have bank feeds linked to their account.

Customers are encouraged to carefully manage their feeds and can now cancel old or unused bank feeds.

Note: When cancelling bank feeds, it’s important to note that, should you wish to reactivate that feed later, an application process will be required. MYOB recommends good housekeeping and account maintenance prior to cancelling any current bank feeds to avoid any additional admin.

Advisors using MYOB Practice tools to manage their client workflows will also see a number of new features and enhancements have arrived in the past month, as detailed below.

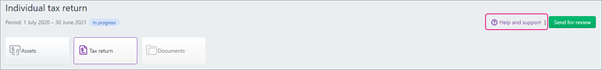

MYOB has added a handy link in the tax return to access all help topics and updates.

Click Help and support to access the page in the product or check out this page.

Creating and using a task just got easier with templates for advisors to use when sending general tasks to their clients.

Advisors can now access and upload documents for a particular year within the compliance module of MYOB Practice

You can now hide the tax file number in a tax return and tax estimate.

For all updates arriving to MYOB Practice, advisors can keep up to date by visiting the relevant MYOB Help page.